Should I think about debt consolidation?

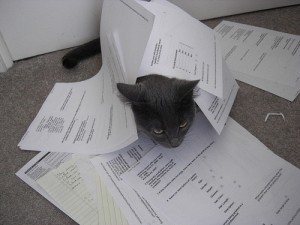

My current financial adviser keeps getting distracted.

You probably have heard the phrase “debt consolidation” before. If you’re like me, the first time you heard it you thought “That’s not for me” or “I will never need that.”

However, we all know times are changing. Lately, the bills just keep coming. I was unemployed for a bit and got behind on a bunch of stuff. Every day I find a different bill in the mailbox. Medical bills, overdue utility bills, car payments and credit card bills pile on top of my cable bill, cell phone bill and rent. There has to be an easier way.

The sooner the better

For the past few months I’ve been struggling. I keep thinking “I’ll get it under control next month.” I know better than to skip credit card payments, so I’ve kept up on those. Meanwhile, bills from other creditors are collecting dust and interest. I know that this will only get worse with time. I have tried the “ignore it and hope it goes away” strategy before. It did NOT end well.

What is debt consolidation?

I know that debt consolidation usually involves getting a personal loan to pay off all of your creditors at once. The slate is wiped clean. Then, instead of paying the hospital, the podiatrist, Visa, Mastercard, a collection agency and Toyota, you just make one payment each month on your debt consolidation loan. ... click here to read the rest of the article titled "I Have Too Many Bills! | Debt Consolidation Part 1"

No comments:

Post a Comment